To satisfy annual reporting requirements under Title I and Title IV of ERISA and the Internal Revenue Code, The U.S. Department of Labor (DOL), Internal Revenue Service (IRS), and Pension Benefit Guaranty Corporation created the Form 5500 Series. Form 5500 satisfies the yearly requirement for pension and employee benefit Plan Administrators to file a report detailing the plan’s financial condition, investments, and operations. It is generally required to be filed by the last day of the seventh month following the end of the plan year (unless an extension has been granted).

During a “normal” year, plans that operate on a calendar year are required to file Form 5500 with related attachments no later than July 31st. If the corporate return is on extension, the Form 5500 may be filed by the due date of the corporate return, with a copy of the extension attached. Additionally, the Plan may request an automatic extension till October 15th on a Form 5558 filed by the original due date (July 31st). If we did not receive a signed copy of a client’s return by July 31st, we applied for the extension on their behalf.

During 2020, because of unforeseen circumstances due to COVID-19, Plan Sponsors were granted an extension of time for certain off-calendar year plan returns that were originally due in April and May, but no additional time was granted due specifically to the pandemic since then. Likewise, there have been many disasters over the years that caused the October 15th deadline to be extended due to hurricanes, flooding and wildfires, just to name a few.

Since the implementation of certain sections of the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, a corporation, partnership, or individual may adopt a Qualified Plan by the due date of their return. This was to keep parity with Simplified Employee Pensions (SEPs) and Individual Retirement Accounts (IRAs), which may be adopted and funded well after the end of the calendar year. In a move no one saw coming, the IRS recently ruled that plans adopted after the end of the year will not have a Form 5500 filing requirement until the second year of the plan. This means that if you retroactively adopted a plan in 2021 by the due date of your return for 2020, you could take the deduction on the 2020 return, but the first Form 5500 will not be due until the 2021 Plan Year return is due. We assume the Form will be changed to somehow indicate that this occurred.

The SECURE Act also increased penalties for late filing of the Form 5500 from $25 per day to $250 per day, with a cap increased from $15,000 to $150,000. There were no changes to the user fees for the Department of Labor Delinquent Filer Voluntary Compliance Program that provides relief from these penalties if the Plan Sponsor comes forward voluntarily and brings these late filings current.

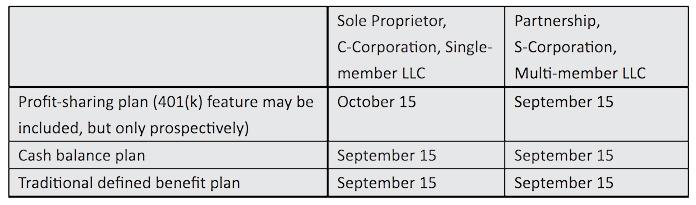

At this time, we will operate under the pretense that other deadlines will remain in place with the understanding they may change. The following is a partial list of upcoming ERISA Plan Compliance deadlines:

- July 31: The IRS’s above-mentioned Form 5500 due date for plans that end on December 31. This is also the deadline to file Form 5558 for those requesting an extension to October 15, 2021.

- September 15: Form 5500 due for plans eligible for an automatic extension linked to a corporate tax extension.

- September 30: Summary annual reports due to participants from plans with a December 31 year-end – i.e., due nine months after the plan year-end or two months after filing Form 5500.

- October 15: IRS deadline for filing Form 5500 after plan files Form 5558 to request an extension.

- November 15: Summary annual reports due to participants if the Form 5500 deadline was extended because of a corporate tax filing extension.

- December 1: Deadline for delivery of certain disclosures to participants including Safe Harbor Matching Notice, Fee Disclosure Notice on participant directed plans, Automatic Enrollment or Automatic Escalation notice for certain Automatic Contribution Arrangement 401(k) plans and the Notice of Qualified Default Investment Alternatives (QDIA Notice).

- December 15: Extended deadline for providing summary annual reports to participants if the Form 5500 deadline was extended because of filing Form 5558.

The Form Series 5500 Series has always been a document of Public Record since the enactment of ERISA, meaning that the data reported may be used as a research, compliance, and disclosure tool for the DOL, and a disclosure document for plan participants and beneficiaries. With the information now readily available on the internet at www.efast.dol.gov, it is also a source of information and data for use by other Federal agencies, Congress, and the private sector to assess employee benefit, tax and economic trends and policies.

If you would like to learn more about ERISA deadlines, please contact us and we will be happy to assist you. Call 954-431-1774.