The SECURE Act has extended the annual deadline by which employers may adopt retirement plans. This can be a great value-add for existing clients, as well as an enticing selling point for new clients — particularly those who are interested in establishing a plan to offset a large or unexpected tax liability.

Before the SECURE Act, an employer had to adopt a retirement plan before the end of its taxable year in order to receive a deduction for that year. With the SECURE Act, employers may now retroactively adopt a retirement plan up until their tax return due date (including extensions) for that year. That means that business owners who realize that they could use an extra deduction for 2020 can still adopt a plan now and receive a deduction for 2020 as long as they extended their company’s tax return due date. This is a fantastic opportunity for many business owners.

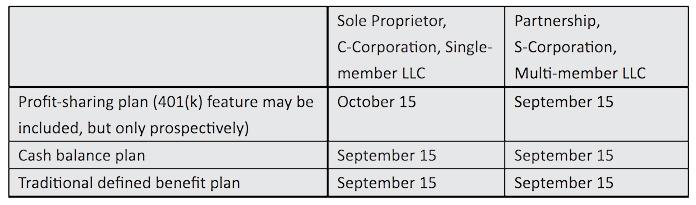

The extended tax return due date for most sole proprietor-ships, C corporations, and single-member LLCs is October 15, and for most partnerships, S corporations, and multi-member LLCs is September 15 (companies operating on a fiscal year basis may have different deadlines). Both defined benefit plans and profit sharing plans can be adopted retro-actively, but defined benefit plans generally need to be adopted by September 15 to comply with applicable funding rules.

Your Third-Party Administrator (TPA) partners are ready to support your discussions with business owners about these retroactive plans. Be sure to consult with them as early as possible regarding potential new plans to ensure your clients have ample time to get the necessary documentation and accounts established to maximize this opportunity.

The chart below details the practical deadlines for adopting a plan in 2021, making the plan effective for the 2020 tax filing year with an allowable deduction on the 2020 tax return.